For global people because the a team, certain email address details are you to definitely buying a house is far more credible than simply renting. You will find several reasons for having it:

To begin with, there are many unsound factors from inside the renting an apartment. Particularly, the problem of getting with each other within overseas beginner therefore the property owner. It is likely result in a great amount of a lot of problems. Because of the difference between way of living models, plus the unsatisfying every day life is going to impact the data while the well.

Subsequently, playing with a house to support knowledge was perhaps one of the most essential suggests to have foreigners to bundle its property. To purchase a house isn’t just an easy way to real time because of the your self, and in addition an approach to lease they to many other youngsters. Rising rents may also increase the worth of the house. Usually, whenever for every occupant cues a lease, discover a yearly increase in the newest lease. Depending on the area, the rise is frequently from the 3-5%. Land which can be next to colleges aren’t a problem to help you lease.

step one. Getting ready this new Down payment

If you’re inquire is also people from other countries purchase possessions into the u . s . having highest home prices and a hot markets. It is recommended that you may have at the very least an excellent 20% down-payment at your fingertips with your Decide status. The aim is to have the rely on to grab a property. Of a lot global children that only come working you want their parents’ assist to finance this new advance payment.

In addition to lead financial remittance. You can even prefer particular higher worldwide money transfer businesses, including Money Gram and Wester Relationship. Such remittance platforms be more specialized and you can credible. And also the charges was somewhat below finance companies, additionally the coming date would be smaller.

dos. Learn about Your credit rating

Should you want to pay quicker for the loan, and get an even more high priced home with quicker advance payment, you really need to remain a good record.

The length of your credit score, the number of credit lines, a brief history away from mortgage payments, the sort of borrowing, and so on. Most of the have an impact on your credit rating. Fico scores was closely pertaining to someone’s lifetime or take time and energy to build. What is very important is the FICO rating .

Fund is actually listed in the measures, constantly 20 affairs a level. Getting a great Jumbo financing, it is 760-780 getting tier step 1. The second level is actually every 20 affairs. Antique finance try 740 having tier step 1. And if you’re above 760, the pace could well be a little straight down, but not by far per month.

Inside techniques, you’ll need to come across a realtor. An agent was a person in a bona-fide property relationship. They have high criteria plus significantly more tips to locate for the most authoritative data and you may statistics on how best to create yes the thing is the best property for you. Also, they are guilty of helping you to: Guide viewings; Praise viewings; Discuss prices; Answr fully your inquiries Montana personal loans bad credit and you will concerns.

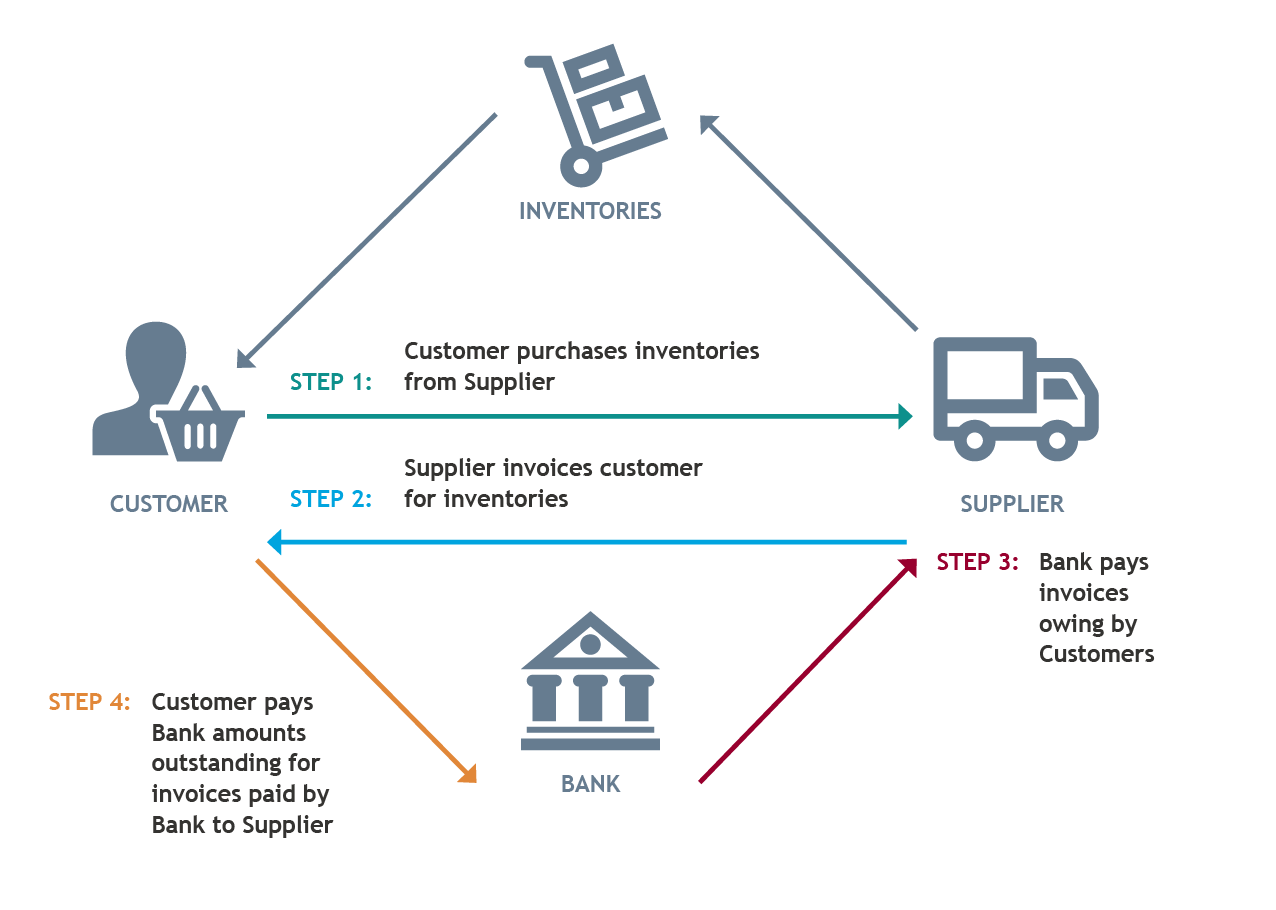

4. Get a hold of a loan company

Financing in the united states is obtainable of an option regarding banks. Loan formula may include lender so you can financial, and you will from one state to another. For several reputation, additional capital supplies, suitable loan streams aren’t the same. Therefore, what sort of financing station would be chose, or would be reviewed into the specific situation. To carry out a loan you ought to offer your passport, business information, earnings advice, and you will established offers.

But not most of the loan providers can give finance in order to children towards Choose so you’re able to manage risk. You may still find specific loan providers in the industry that may render finance so you can pupils with the Choose. With regards to rates of interest, Decide loans are towards level having H1B. While they was relatively greater than normal funds. In terms of exactly how much you could potentially use, loan providers fundamentally merely enable you to carry to forty five% of your own pre-taxation income inside the monthly premiums.