When you are not able to qualify for an interest rate due to items such as for example financial obligation, spotty a position record, or poor credit, you can consider exposing an effective co-signer to simply help. not, it is important to understand the potential positives and you will risks with it.

Towards and front side, a beneficial co-signer increases your chances of qualifying for a loan and potentially allow you to acquire extra money or see a much better rate of interest. The lending company tend to glance at both their in addition to co-signer’s financials, credit, a job, or other facts to choose your qualifications into the loan.

The huge benefits of experiencing a beneficial co-signer for your financial

The greatest brighten is the fact an effective co-signer causes it to be simpler to qualify for a loan. After they lay the label on your financial app, the loan lender upcoming considers each of your financial activities.

They appear at the credit rating, credit history, bills, money, a career history, and much more, apart from that of your own co-signer. Following, they normally use all of that research to decide 1) if you qualify for a home loan and dos) exactly how much you can borrow when you do. Occasionally, you will be able to find a more impressive-sized mortgage or top interest rate that have a great co-signer when you look at the tow.

The downsides of having an effective co-signer for the financial

Unfortuitously, that’s on in which the benefits out of co-signers end. Introducing a great co-signer on your home loan can come with certain serious risks – particularly on co-signer you choose. For example, these are typically providing culpability for your home loan, when you neglect to build costs, they’re going to need certainly to step-in and choose up the slack. This might end in economic strain and you will affect its credit rating in the event the they aren’t prepared.

When they don’t pick-up those people mortgage repayments (otherwise are only unaware you dropped about), it will have grave effects financially. Not merely you can expect to the newest non-commission hurt their credit score, nonetheless it might enable it to be much harder to get other conventional financing, handmade cards, and you will lending products, as well. This may even perception their job and you will housing candidates, because so many businesses and you can landlords explore credit reports when comparing the brand new uses and tenants.

A different sort of concern is that it can produce pressure in your relationships on the co-signer. If one makes a later part of the commission too often otherwise the non-percentage begins to feeling their finances otherwise borrowing from the bank, there can be particular resentment otherwise outrage to handle. It might also result in their relationship to break apart completely if the trouble will get crappy adequate.

Co-signer frequency high inside the costly says

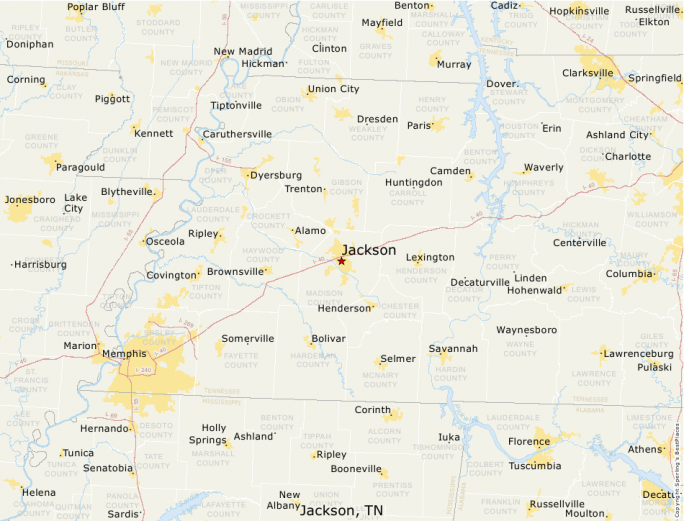

Says from the West and Northeast, which often features highest home prices, have significantly more younger homeowners counting on co-signers, as The southern area of and Main You.S., with more reasonable construction locations, has less. Considering look of the Deck using investigation about Government Monetary Associations Test Council’s Real estate loan Disclosure Work, says have been rated by the percentage of more youthful homebuyers (34 years of age or younger) having an older co-signer (55 yrs old otherwise earlier). In case of a tie, the state to your highest average value of having more youthful homeowners having a mature co-signer try ranked large.

Whom is fool around with mortgage co-signers?

Co-signers should be made use of if you find yourself toward cusp off qualifying – meaning you have a somewhat highest obligations-to-money proportion, your job records is a little spotty, or you have some late costs on the credit file.

Also top reserved having very personal friends or family unit members – people that your faith to pick up the fresh loose on your own mortgage payment if you slide with the crisis. you should make yes it is men you have got a great foundation that have.

If you’re struggling to make your repayments toward financial, it could set a-strain towards the relationships. That have a powerful foundation right away can help make demands with your home mortgage a while easier to defeat.

Going for a trusting co-signer

In advance of considering a beneficial co-signer, you should deplete various other options for improving your credit get, cutting financial obligation, or growing earnings. Likewise, you will want to very carefully like a beneficial co-signer who’s trustworthy, responsible, and you will understands the risks inside it. You should also provides an open and you can truthful talk using them towards duties and possible effects.

Eventually, you should make sure to are able to afford the loan financing yourself and possess sufficient boundary finance set aside having unexpected expenses. Exposing a good co-signer might be a good product, it are used with alerting and you may consideration out of the potential risks.

The conclusion into co-signers

Home loan co-signers helps you more quickly be eligible for a loan, but they’re not perfect. Indeed, they arrive with many risks – each other into the co-signer and to your own reference to them.

Before you entice an effective co-signer, get in touch with a hug Home loans place of work in your area to see if you would be eligible for an interest rate on your own individual. Your loan administrator may also talk about exactly how installment loan company Blue Mountain MS a beneficial co-signer could impact your own financial software.

Express which:

- X