If you have late payments on your own credit record, you may still find particular activities to do discover yourself back on course.

- Bad credit Mortgages

Just how do late costs effect a home loan software?

In the event that prevent of day is actually eyes however your currency would not quite extend to cover any outgoings, you may find your self putting off payments getting things like Netflix, your cell phone statement and maybe even your vehicle money. But what impression does paying the expense late enjoys when it concerns applying for a mortgage?

It might not additionally be some thing you’re interested in just yet however, remember – borrowing blips can be stay on your credit history for up to six many years. Your future notice could thank you for maintaining your instalments.

Do-all lenders refuse software with late costs?

Not all but many commonly frown abreast of a software having later repayments, even though of the a few days because the in that way, you show that you are not in a position to keep bills. Having a lender or mortgage lender, that is as well risky while they desire to be reassured you to definitely you’ll be able to help make your mortgage payments promptly along with full.

The good thing? Taking home financing or remortgage isn’t really impossible with late costs towards your listing. You only need to understand where the loan providers was which will neglect all of them.

Your other facts can deal with the choice too, with respect to the financial. For the majority of, it will be an even-up no but there are more which can be lenient when it comes to later or skipped money, especially if you can also be establish why you overlooked the newest fee and you can if for loans Windsor example the other variables which affect your affordability to your financial have been in a acquisition.

What other affairs apply to my value?

- The degree of money you have made

- The stability of the earnings

- How much obligations you may have in relation to how much you secure

- Just how many dependents you’ve got

- Your credit report, plus details about if you’ve paid back expense, inserted so you can vote whenever you’ve been declined to have borrowing from the bank

- Your actual age (how romantic you are to help you old age)

- If or not your trust the overdraft otherwise playing cards excessive

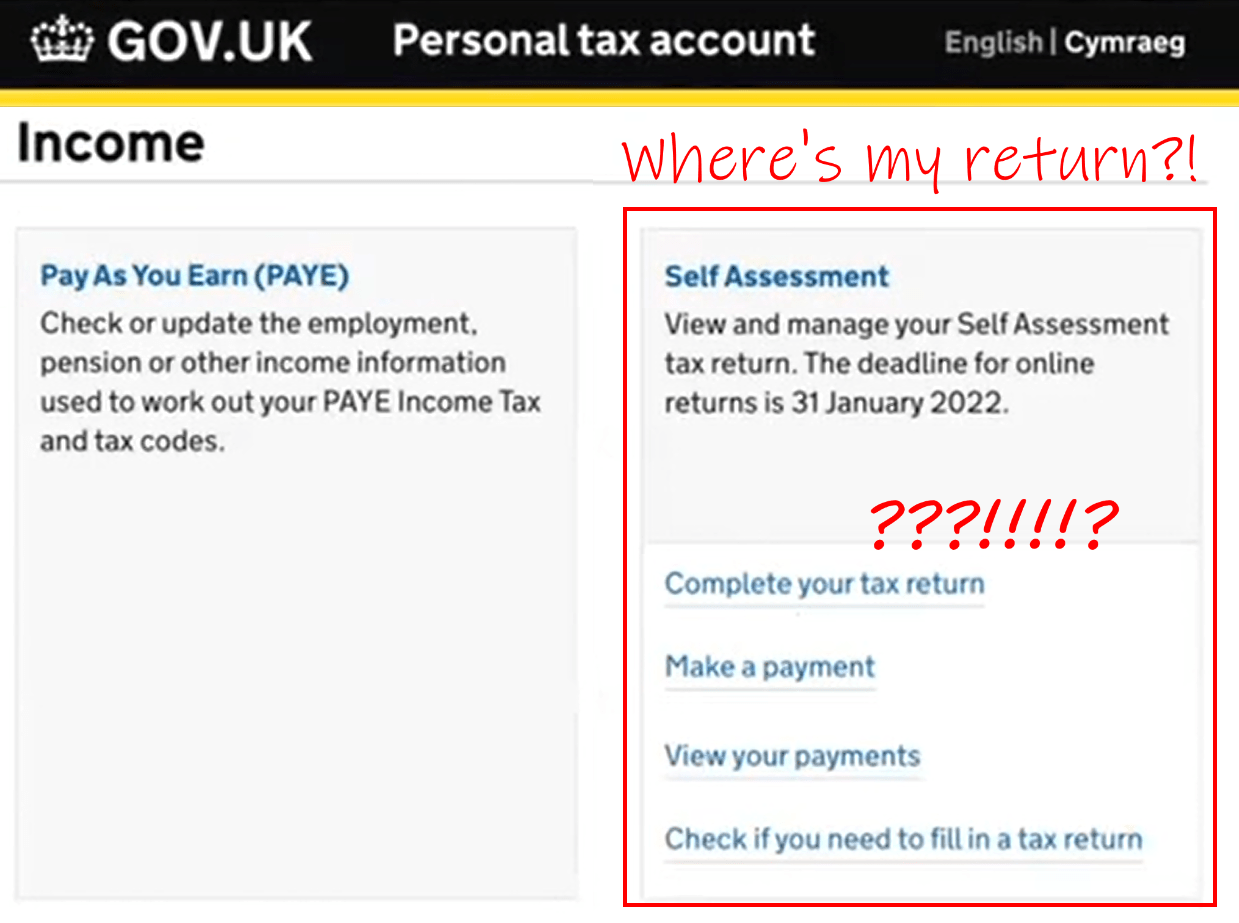

Just how will a lending company know if We have made payments late?

They look at your credit history which shows one missed otherwise late payments to financial institutions otherwise electricity people such as for example EDF or South Water. There are some some other credit history businesses (called CRAs) however, usually, gives often refer to Equifax, Experian and you will Clearscore. Frustratingly, each one of these holds some other facts about your as the most are current more often than someone else.

For this reason it is better to evaluate every one before you make an application for a home loan or any kind of borrowing from the bank. When you see something which does not research somewhat correct or need updating, you can get in touch with the first collector (it can inform you who which is on your report i.age. About three Cellular) and ask for that it is got rid of.

You do not continually be profitable and it may end up being monotonous but it is really worth giving it a go, specifically as the a far greater credit history and you may get helps you supply mortgage issues having all the way down rates. Usually, the lower the pace, the least expensive your mortgage, in the event other variables such charges and exactly how much you happen to be credit is also affect the complete costs.

Wisdom your credit report

Examining your own statement does not connect with your credit score or the notes on your declaration but once a loan provider works a hard view (always because the you’ve put on them to possess borrowing) it does. After they look at the declaration they’ll certainly be able to see whether or not almost every other lenders keeps rejected you, exactly how many you’ve applied to and you will in this just what time frame.