About how to outline the most recent monetary and business criteria, we were reminded away from a classic idiom: we simply are unable to see the forest on woods. Nowadays regarding fast-swinging, multi-faceted news, the audience is therefore inundated because of the information and you may, oftentimes, conflicting advice that individuals fail to understand the large visualize: It is all part of a routine!

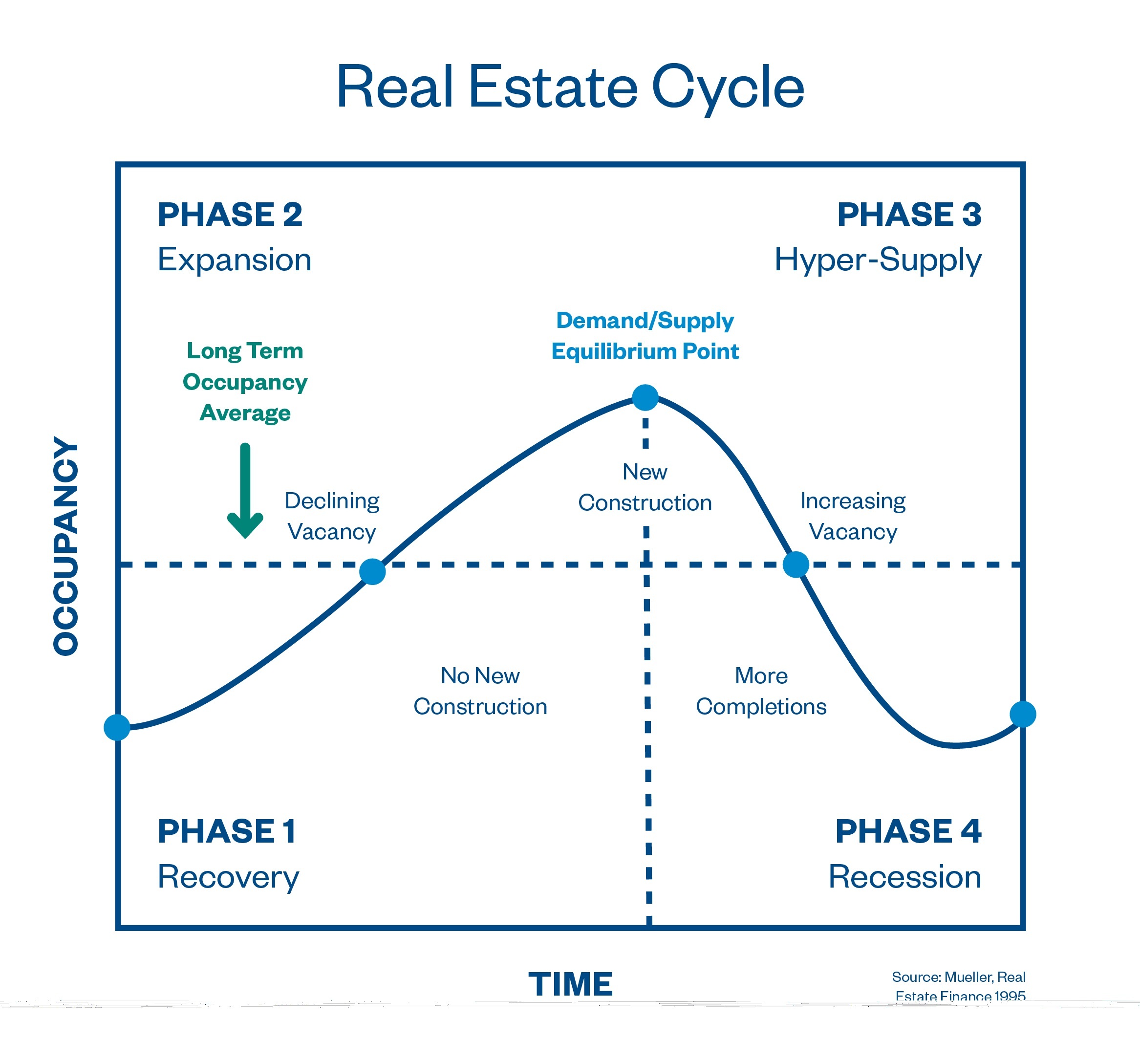

Providing one step right back, it is useful to realize that discover four levels so you can a genuine property period because in depth throughout the surrounding diagram: extension, hyper-have, recession, and you may recuperation. While each years is exclusive so there is actually variations in how specific places and you will properties would, all the schedules realize a foreseeable development one industrial a residential property owners, plus are formulated household people manager/operators, must look into whenever creating one another short- and you will much time-term proper and functional team arrangements.

Distinguishing where the audience is in the modern period enables us to source past cycles to have knowledge toward requested monetary formula and user demand moving forward.

Investigation a full Duration

Taken from the good Market meltdown of 2008, we slowly transitioned from the data recovery phase, which was accompanied by a prolonged expansion several months. Nowadays, it could be reasonable to state that really areas was from the extension or hyper-have stages with . Private segments and assets sectors tend to vary with respect to time as they transition anywhere between levels which have multifamily characteristics outperforming almost every other circles for example retail and you will work environment during previous markets schedules. The second graph gifts secret monetary analytics ahead of, throughout, and you may after the COVID-19 pandemic:

Of numerous view the apartment field because another proxy into MHC industry considering the thorough business data which can be found. Present surveys and you can accounts into apartment markets reveal a bounce in the rent and you can occupancy growth in second half 2022 as the the dramatic change in financial policy appears to be affecting individual conclusion. In the united states, single-members of the family tools around structure . At the same time, multifamily the new framework provides went on, particularly in center . Depending on the National Relationship off Real estate agents, single-relatives houses begins from the 3rd quarter out of 2022 was in fact 13% underneath the pre-pandemic historical average whenever you are multifamily built on the fifty% much more equipment versus pre-pandemic average. Particular gurus point out extended framework conclusion waits due to the fact a reason multifamily hasn’t slowed down significantly more, but multifamily consult is additionally benefiting from grows inside domestic financial pricing, having adversely impacted solitary-family relations homes affordability. However, it is asked you to definitely rental rates have a tendency to reasonable when you look at the 2023, no less than in a number of ily have being additional immediately when more folks is actually moving back in that have friends or postponing venturing out of the family members house, that’s reducing the newest home formation. So, if you are pundits have a tendency to disagree into the identifying just what phase of one’s cycle our company is during the up to pursuing the fact, it is obvious i have produced a beneficial rotate.

Numerous Markets Forces Feeling World

It’s very really worth listing that each stage has its novel economic and you can political background, and the newest ecosystem has furnished new Government Reserve and you can policymakers plenty to adopt: persistent rising cost of living because of extreme monetary and you may fiscal stimuli, an unusually reduced jobless rates due to declining employees contribution, more than questioned user expenses, and you may a combat from inside the European countries. The latest Provided made it clear that it’ll continue to be steadfast inside the toning monetary policy up until rising prices abates, regardless if it means overcorrection.

The brand new continuous low unemployment rate also offers governmental support for further tightening if needed. With that said, as we assume the fresh new Provided will continue to raise costs from inside the 2023, that will not suggest brand new ten-12 months You.S. Treasury yield increases during the lockstep. The connection sector, and particularly offered-label treasury bond people, operate favorably whenever rising prices expectations was less. Immediately after hitting an all-date low yield off 0.52% in the 2020, the new ten-year You.S. Treasury yield exceeded many a lot of time-label averages whether it struck 4.34% during the (the yield averaged 2.91% and you can step three.90% over one history 20 and you will three decades, respectively).

Alterations in demographics are something both for policymakers and home owners to look at. One reasoning unemployment provides stayed reduced is really because we’re enjoying, and certainly will continue steadily to come across, a trend of less operating-age Americans and retired people. With regards to the Bureau out-of Labor Statistics, brand new labor pool are projected to grow across the second ten ages in the the common annual speed of 0.5%, which is a much slower rate in comparison to recent years. Activities are reduced inhabitants development plus the aging of your U.S. population in addition to the decreasing labor force participation price. Simply put, selecting a good staff will stay problems so property citizens can be ready to budget for large payroll costs. At exactly the same time, it market development will get effects getting required places and features having properties to keep aggressive.

Indeed, there’s a lot getting people to take on when designing business arrangements. Out of a money position, we think an instance can be made that the bad from brand new expanding interest rate improvement months was behind all of us, barring a pay day loans Sawpit CO jump of one’s latest change in inflation strategies. Having home owners as a result of the time and construction of the next money, rising prices would be secret. While you are there’ve been much discussion about a most likely market meltdown on new opinions, you should just remember that , this really is coming shortly after an effective prolonged age of large assets opinions adopting the Higher Recession and you may you to definitely occasional alterations try healthy into sector over the long identity.

Regarding the Article writers

Tony Petosa, Nick Bertino, and you can Matt Herskowitz is actually financing originators in the Wells Fargo Multifamily Investment, concentrating on providing financial support to have are manufactured domestic teams by way of their head Federal national mortgage association and Freddie Mac computer financing apps and you will correspondent credit relationships.If you prefer to receive future updates from them, otherwise a copy of their Are designed Family Community Industry Improve and Financial support Handbook, they truly are hit during the tpetosa(at)wellsfargo, nick.bertino(at)wellsfargo and you will matthew.herskowitz(at)wellsfargo.

MHInsider is the top source of reports and guidance on manufactured housing marketplace, that is a product from MHVillage, the big areas to track down cellular and you can are built land for rent and you can deals.