Extremely subprime mortgage loans in the us was awarded to help you members of the guts groups individuals who would have been eligible for a routine primary home loan based on the earnings, property and you may credit score. The present day impression that every subprime mortgages in the us was indeed sold to lessen-earnings organizations try for this reason wrong. This might be among the findings from a not too long ago composed book titled Subprime Metropolises: The fresh Political Cost savings off Financial Markets’, gathered beneath the editorial supervision of Manuel Aalbers, assistant teacher within the Societal Geography and you can Think during the College from Amsterdam (UvA).

The publication provides efforts of best globally academics including David Harvey (Area University of brand new York) and you will Saskia Sassen (Columbia School and you may London area School off Economics). The newest article authors you to definitely led to Subprime Towns and cities was indeed upset on standard build of stuff towards the financial locations and overall economy by the economists penned on the published media and you can educational journals.

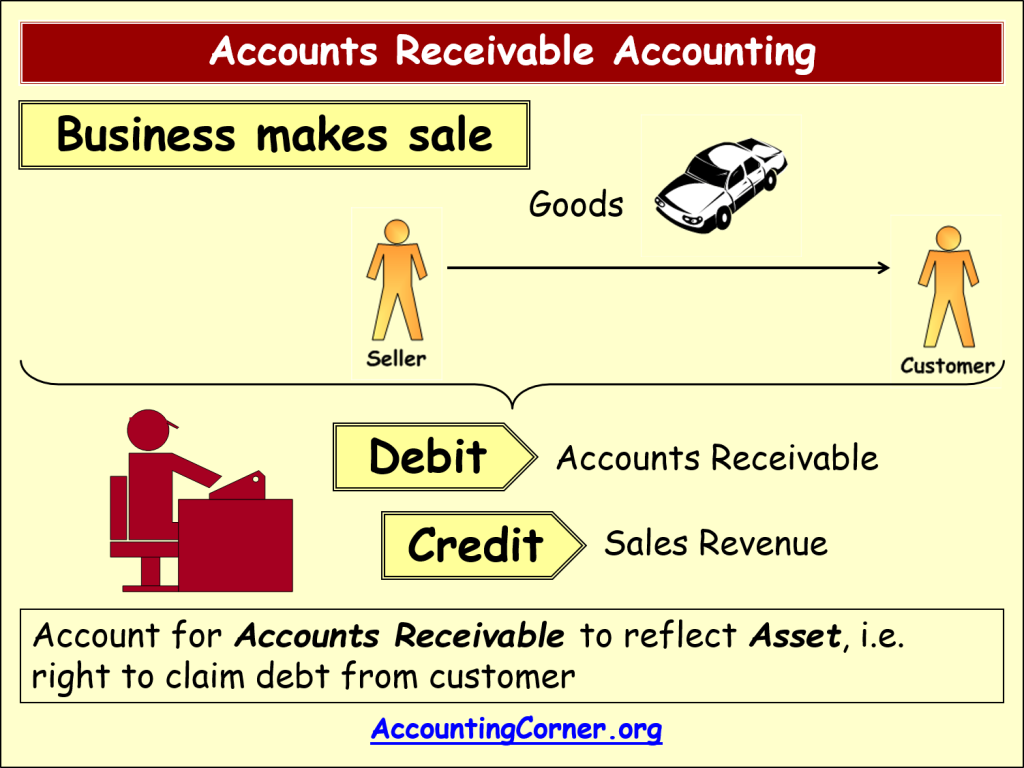

Securitisation

A section of the publication is targeted on securitisation (brand new reselling of financial portfolios in order to buyers). The modern economic crisis often is mostly attributed into securitisation of mortgage loans. Subprime Places generally confirms which evaluate, however, anxieties the necessity for nuance. The technique of reselling mortgage loans could have been ongoing getting : reselling anticipate toward reduction in interest levels and started banking companies so you’re able to thing much more credit. The problems become whenever funding finance companies diversified regarding reasonable-chance funds and you may become reselling subprime mortgages that were appraised as the lowest-chance issues of the credit history enterprises.

The new securitisation growth is actually sparked by bursting of the dot-com ripple: money ton for the from the It market or any other the new economy’ sectors is actually purchased a property and you can lending products safeguarded because of the a residential property. This step confirms David Harvey’s financial support changing idea from the 1970s and you may eighties: in times away from crisis, financing usually search for secure capital havens, leading to overinvestment in other monetary circles. Eventually, which overinvestment tend to cause a new crisis. Such as crises specifically those at the same time involving the a residential property and you can monetary circles can be rapidly damage on an international drama one transcends markets limitations.

Crappy fund very likely to getting marketed to help you ethnic minorities

In america, ethnic minorities was expected to feel targeted of the subprime mortgage loans than simply light customers. When comparing to a white members of the family with similar money top, a black nearest and dearest is nearly doubly attending had been marketed a bad financing. Most foreclosure conversion are thus concentrated during the neighbourhoods with high part of ethnic minorities, plus a lot of middle-income group neighbourhoods. Also, the newest subprime money and you can foreclosure transformation have been and additionally extremely centered for the a restricted amount of states: 1 / 2 of all of the property foreclosure sales happened from inside the some says from the southern area-western Us and you may Fl. This is certainly partly because of statutes at the condition height.

The latest monetary guidelines

Control of your own financial field is being modified in reaction to help you the fresh financial crisis. Of several experts claim these types of the fresh new guidelines is actually intended for steering clear of the early in the day drama instead of the next that. This really is partly as a result of simple reasoning: whenever one thing goes wrong, efforts are built to prevent the exact same mistake out-of happening once more. Even more problematically, even when, new financial statutes are inadequate: even if the the fresh new laws and regulations ended up being in force at date, they’d not have stopped the brand new economic crisis you to were only available in 2007. Many securitisations or other by-product products remain not acceptably managed; an equivalent relates to of several credit score companies and you will mortgage lenders. Really United states lenders aren’t online New York installment loans no credit check subject to the latest has just tightened banking legislation, because they’re perhaps not officially considered to be financial institutions.

Holland provides the earth’s premier home loan markets

When you look at the cousin terminology, the newest Dutch financial market is the greatest international. Even yet in pure data, holland is actually second in order to The uk and you may Germany in the terms of financial debt (leading’ far huge regions such as for instance France and you may Italy). Having a mortgage personal debt regarding 40,000 for every capita (including college students and you will tenants), the typical Dutch citizen features a higher financial obligation as compared to average Greek or American (regardless of if Greece and also the All of us do have higher bills for every single capita regarding the personal markets). The latest Netherlands’ exceptional updates is usually attributable to its real estate loan notice deduction scheme, that’s a lot more reasonable than any almost every other similar design in the industry. That it higher level from each capita home loan obligations is not attributable to higher a property pricing; property cost a lot throughout the Netherlands once the their customers had even more the means to access highest fund up until 2009, just like the home loan rate deduction program aided drive right up pricing. In the event your current scheme isnt modified otherwise strategies prove ineffective, all of our financial obligations will continue to go up from the a more quickly rate than just the house pricing and earnings profile.