Remember that for each homeowners’ reasons in order to have the home loan refinanced, and you will what they desire regarding the refinancing, should be nuanced, that’s rarely a cut right out-and-deceased topic. Do a little calculations that will be right for your specific disease and you can be honest which have yourself on how long you want to stay in your home. Undertaking those two anything will assist you to determine if or not an excellent no-closing-pricing option is truly the best course of action to suit your refinancing a mortgage.

Sign up for A mortgage Refinance

The loan refinancing processes is also, naturally, feel complicated and daunting. To have residents that specifically concerned about saving cash and you will reducing this new economic load of its mortgage, it could be difficult to discover whether or not a zero-closing-prices refinancing is actually the best option. Thankfully, advantages instance Assurance Economic offer productive, professional refinancing characteristics and certainly will aid you with each other every step out-of the loan refinancing process

Title insurance coverage is obtainable to safeguard the financial institution, and on affair, your, new homeowner, also

Warranty Economic prides in itself into the their people-first, service-situated method of property and refinancing mortgage, one of other features. We’re a different, full-service home-based mortgage banker. Website subscribers can feel confident in the options and you will sense. Because seller/servicer accepted getting Federal national mortgage association and you may Freddie Mac computer, and you may issuer-recognized for Ginnie Mae, we can underwrite them all inside-house no need to love outsourcing your loan details. On top of that, we have been experienced with every type out-of a home loan on the marketplace, including, however restricted to Virtual assistant funds, FHA finance, structure money, non-QM funds, and you will modular home financing.

Members out-of Assurance Monetary should expect very good results from our handling of its refinancing. Quite a few clients get to down monthly obligations, consolidated loans and elimination of PMI. Most are in a position to pay back its mortgages less and increase its home’s guarantee. That have Guarantee Monetary carrying an average score of 4.9/5 stars out of tens of thousands of reviews, our very own potential clients can feel confident in all of our 20 years off elite experience, the outstanding support service, and you can our very own comprehensive possibilities towards the all aspects of the home to invest in and you may mortgage refinancing process.

The of several awards speak to the caliber of all of our characteristics. The audience is satisfied getting A+ rated because of the Bbb. From 2014-2018, we have been named Finest Metropolises to operate in Rod Rouge of the Business Report. In addition, Personal Survey entitled all of us Ideal Mortgage lender having Customer satisfaction in 2019, therefore we were found in Home loan Government Magazine’s a number of the latest fifty Ideal Home loan Organizations to the office To possess into the 2020.

It is the fulfillment to simply help so many people for the achieving their dream of homeownership. E mail us today, and we’ll fit everything in we are able to to make their mortgage refinancing an actuality!

Term insurance costs. online personal loans no credit Nevada When you to start with purchased your home, you came into hands of the term. Possessions titles are typically stored because the public listing inside courthouse ideas. So it look is done to confirm that you are in reality the latest legal owner and to know if you’ll find any liens against the property. They talks about the expenses should there be one errors throughout the term data procedure. The price of name insurance rates depends on various situations, including advance payment matter, loan amount, and property area, as well as others.

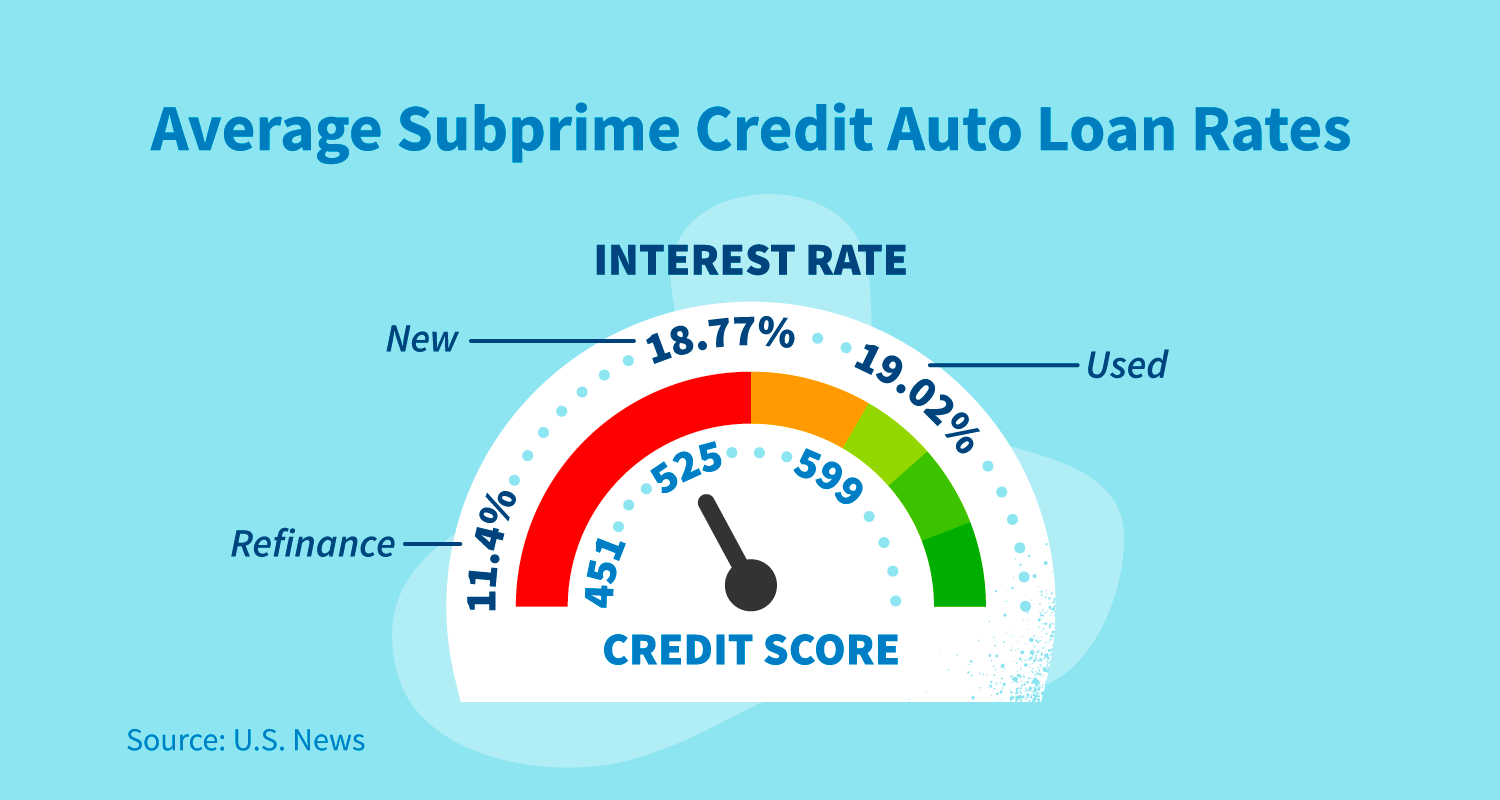

Alter your credit rating. Lowering your total personal credit card debt could make the instance research less risky, hence, more desirable to help you potential lenders since you think refinancing. Your credit score is a critical determinant on the financial interest levels, therefore setting it up from the best possible figure before you refinance is often wise.

Yet not, if you are paying more 4% or 5% appeal on your own latest home loan, refinancing tends to be a great action to take, whilst may lead to reducing one to interest – especially for residents whom propose to stay-in the most recent home for almost all a lot more a long time. For these types of people, a no-closing-rates mortgage re-finance can end shedding all of them tens of thousands of dollars because of numerous years of large interest rates, instead of just paying the will cost you initial.