Personal loans is actually a terrific option for of several points because they are usually unsecured, definition you’re not placing your property at stake when the you may be unable to pay it off.

not, within the particular products, a consumer loan might not be ideal answer. Listed below are about three almost every other mortgage choices to believe:

Home loans to own unmarried mothers

Whenever you are trying to get property obtainable, you want a mortgage loan as opposed to a consumer loan.

A mortgage uses your property while the collateral into the loan, for example you’re going to get straight down pricing than might on the an effective personal bank loan, but if you will be struggling to improve financing costs, the financial institution could foreclose on the household.

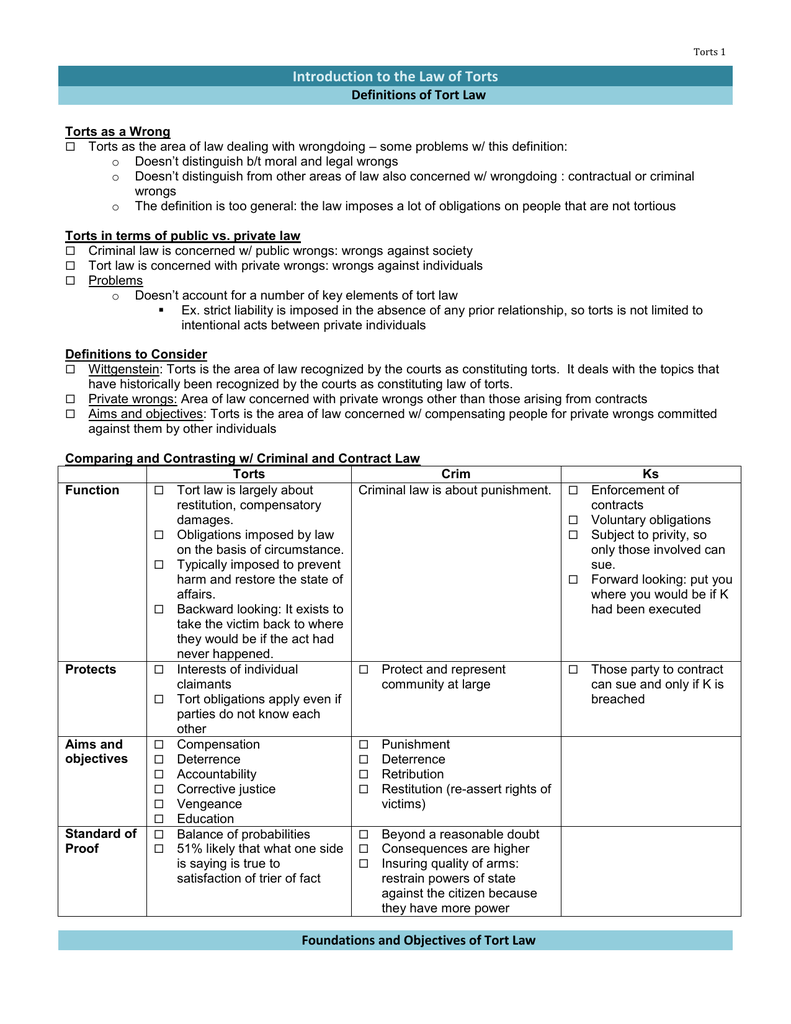

- FHA funds: Made to create real estate cheaper for middle- and you can lowest-earnings first-big date homeowners.

- Virtual assistant money: No-down-fee money to have armed forces players, pros, and their thriving spouses.

- USDA money: Zero down-payment to have eligible homebuyers into the outlying section.

- HomeReady and you can HomePossible: Low-down-percentage mortgages getting reduced-earnings consumers.

Federal services is obtainable due to enough apps to help you create finishes fulfill and offer the basic principles your family need. Such applications makes it possible to pay money for restaurants, pick and you will purchase casing, score medical care insurance, or receive quicker-costs child care.

Charitable communities and you may county and you may regional advice programs https://paydayloancolorado.net/fruitvale/ is likewise open to help you get the assistance you prefer.

Instructional aid having solitary moms

Support is not just readily available for your traditions will set you back. While you are making an application for an education to help expand your career, choices for support outside old-fashioned student loans tend to be trying to get scholarships and grants.

Is actually a loan the right selection for you?

When you begin looking in the financing solutions, you might ask yourself how to decide which is perfect for you. All of the debtor features unique choice considering their requirements and monetary state.

Of a lot loan providers would a smooth credit eliminate, in the place of an arduous borrowing eliminate, in advance of they offer a first mortgage offer. In such a case, it will not damage your credit score to evaluate the options which have numerous lenders.

You may want to observe how much you be eligible for and what your monthly payments looks such as for instance before you could complete an enthusiastic software. You should definitely are able to afford your payments; otherwise, you’ll be able to explore another type of way to obtain help.

- APRs: The brand new annual percentage rate in your financing will tell you the newest overall yearly price of your loan, such as the interest and you may related costs. It helps give you a far more precise total price of the loan. The higher the fresh Apr to the mortgage, the greater you’ll spend when you look at the interest and you can charge.

- Loan amounts: More lenders ounts they truly are prepared to offer. Comment per loan amount to determine what ones meet your needs.

- Mortgage installment words: Just how long have a tendency to it lend you money, and you will just what will your payment per month getting? Finance with a longer installment name will mean the payment per month was smaller, nevertheless might also find yourself paying even more into the focus.

Actually brief variations in your Apr otherwise repayment timeline have a powerful influence on your allowance. Have fun with an unsecured loan calculator in advance so you know what you are able to afford.

Ideas on how to sign up for a personal bank loan as an individual moms and dad

Obtaining a personal loan is simple, it would not grab long from your plan. Of several loan providers will let you implement on the web in a matter of times. Use these five methods to try to get a consumer loan:

- Look at your credit rating

- Determine whether you would like a personal bank loan that have a good cosigner or co-candidate