(CLEVELAND) Today, KeyBank revealed this possess funded over $1 million during the KeyBank Household Consumer Loans SM because the program’s discharge within the of homeownership inside the places that the program is available.

That it milestone comes just under 12 months following the launch of the applying and you will 8 days once KeyBank increased this Special purpose Borrowing from the bank Program 1 by $2,500 to incorporate $5,000, on closing costs or other pre-paid down charge that will incorporate financial support yet another family, to help you homebuyers for the purchase of qualified services.

A property is one of the most important commands a guy otherwise friends renders. Within Trick, we feel you to definitely match organizations are those where all the residents has accessibility homeownership, said Dale Baker, president of House Credit during the KeyBank. I make an effort to help our teams thrive of the not merely bringing feeling so you can sensible financial loans, apps, and you may characteristics, as well as bringing educational assistance and you can head money.

Has just, KeyBank’s Fair Housing Times Poll found that almost one to-third (31%) out of participants said it didn’t try to find any advice or information into the household customer direction programs, which will surely help beat traps to homeownership. Also the Home Consumer Credit, the following software are offered for qualifying features in eligible communities:

KeyBank worked in order to bridge you to gap with regards to Special purpose Credit Software, a continued commitment to helping all potential homeowners make their fantasy regarding owning a home a real possibility

The main Solutions Family Guarantee Loan brings sensible terminology to possess borrowers with qualifying services in order to re-finance their primary house so you can a lowered interest rate, combine financial obligation, money home improvements, or make use of

their guarantee when needed. So it loan enjoys a predetermined rates, without origination percentage, and you can a primary otherwise second lien selection for money around $100,000. As the system began to your , KeyBank financed $cuatro.eight million in funds, helping ninety five customers secure fund due to their no. 1 household in the designated teams.

The fresh new KeyBank Neighbors First Borrowing was designed to help homebuyers inside the licensed components across Key’s footprint plus in Fl by providing upwards to $5,000 when you look at the credit to be used to possess settlement costs in order to pre-paid back fees that may incorporate resource yet another domestic, and home loan, ton and you can possibility insurance policies, escrow put, a residential property fees and you can for each and every diem notice. Out of , KeyBank financed up to $sixty,000 for the Locals Very first credits, providing a dozen readers achieve its dream about homeownership on the being qualified areas where the application form is available. Including, by , KeyBank possess $ten.8 mil in home mortgage software for about $345,000 from inside the Natives Earliest Credits to help 71 customers (inclusive of this new financed credit shared significantly more than) on the way to homeownership during these cities.

Having both the Neighbors Basic Credit and you can KeyBank Domestic Visitors Borrowing set up, Trick have get credits available in more than 9,five hundred census tracts, level areas where 10% of one’s U.S society lifetime. KeyBank in addition to committed to expenses more $twenty five million in gives, fee waivers, and you can revenue over five years to boost financial financing in bulk-minority communities, as well as more $one million so you can homebuyer education and other people help.

Learn more about KeyBank’s home financing solutions and you can programs, determine whether property qualifies for Special-purpose Borrowing from the bank Applications, or get started on the journey to homeownership when you go to secret/communitylending.

step 1 Special purpose Borrowing from the bank Programs was, basically, software which might be dependent to meet up with special public need or even the need away from financially disadvantaged persons from the extending borrowing to help you individuals exactly who would getting rejected borrowing from the bank otherwise do discovered they towards quicker advantageous words, not as much as particular requirements. See fifteen You.S.C. 1691(c)(1)-(3); 12 C.F.Roentgen. 1002.8(a).

KeyCorp’s root trace straight back nearly 200 ages in order to Albany, New york. Based in the Cleveland, Ohio, Trick is among the state’s biggest bank-oriented monetary attributes companies, with possessions of around $195 million within .

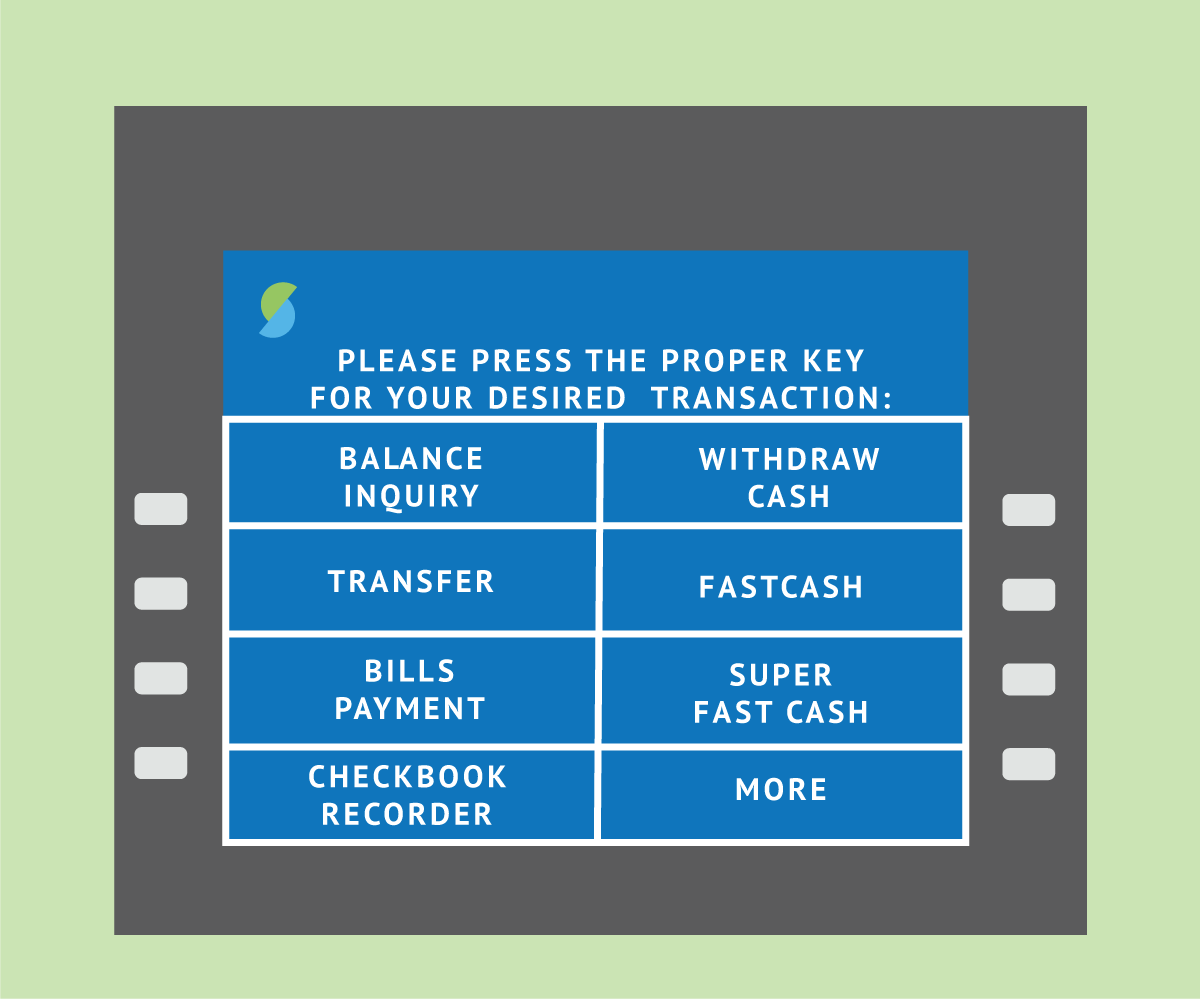

Trick provides put, financing, cash government payday loan companies in Calvert Alabama, and you can financing properties to individuals and you may enterprises from inside the 15 claims lower than title KeyBank National Organization due to a system of approximately 1,000 branches and you will approximately step 1,three hundred ATMs.

To have information on the present day county regarding local avenues in order to address questions you have got, along with whether or not a house qualifies to possess Key’s Special purpose Borrowing from the bank Applications, KeyBank Home mortgage Officers are around for help

Key has the benefit of a broad list of higher level business and financial support banking points, instance merger and purchase pointers, social and private obligations and you can guarantee, syndications and derivatives so you’re able to middle industry people inside selected areas during the the usa in KeyBanc Capital

elizabeth. To learn more, head to KeyBank are Member FDIC. Equivalent Houses Financial. Mortgage and Home Security Lending products provided by KeyBank are not FDIC covered or secured. NMLS #399797